Hydroelectric dams are extremely capital intensive investments, which is to express they have very large fixed costs, and reasonably little working prices. As a result, it is very difficult to fund producing a hydroelectric dam, but fundamentally after the preliminary (capital) infrastructure investment was paid down, a hydroelectric dam will create relatively high profits with little limited operating costs.

Valuation Analysis

Along with the highly money intensive initial investment related to hydroelectric dams, the commercial opportunity cost may be expressed since the after that most useful usage for water for the reason that ecosystem. For the state of Vermont therefore the Lake Champlain Basin this will most likely end up being the “value of a more healthful ecosystem while the economic advantageous asset of not having a dam in almost any offered area.” (Wilkonson-Ray, 45) the commercial value of a hydroelectric dam may be the difference between the cost of electricity procured through the hydroelectric supply plus the cost of electricity acquired from the next most useful option. These cost benefits are usually the result of the high-fixed low-variable cost nature of running a hydroelectric power-plant. In 1995 the average variable costs of operating a hydroelectric power-plant were about $5.89 per megawatt-hour (MWhr), when compared with the common fossil-fuel steam plant where in actuality the normal expenses of creating electrical energy ended up being approx. $21.11 per MWhr. (Harpman, 3) In this particular situation the economic value created by the average hydroelectric dam was about $15.22 per MWhr.

Another essential factor that should be considered in the economic price produced by hydroelectric dams could be the time and also the demand for electrical energy consumption. Because of their low-variable expense nature, hydro-power dams tend to be economically most effective during top use hours as soon as the need for power, plus the progressive prices of meeting this need, are the highest. (Harpman, 4)

Financial Feasibility into the Lake Champlain Basin

| Title of Stream/River | Energy Potential(KW) | Return in 365 days($) | Cost of Plant Installation($) |

| Saranac River | 706 | 3, 708, 063 | 1, 623, 800 |

| Lamoille River | 1394 | 7, 324, 993 | 3, 206, 200 |

| Bouquet River | 137 | 722, 348 | 315, 100 |

| Salmon River | 39, 909 | 18, 400 | |

| Winooski River | 1208 | 6, 349, 960 | 2, 778, 400 |

| Laplatte River | 17 | 92, 113 | 39, 100 |

These quotes show the vitality potential of several ny and Vermont rivers which are Lake Champlain tributaries. The cost of plant installation only includes the vitality generation plant because it is also hard to determine the price of the particular dam construction because it differs on a case-to-case foundation. These prices additionally usually do not take into consideration any externalities which are of hydropower. Centered on these findings, it's very economically feasible to include more hydropower in the Lake Champlain Basin. The payback on investment for many of this rivers is under a year for plant set up. The return is really a lot higher than the financial investment, that even though the price of the particular dam construction is considered, it's still extremely economically feasible.

Functions Cited

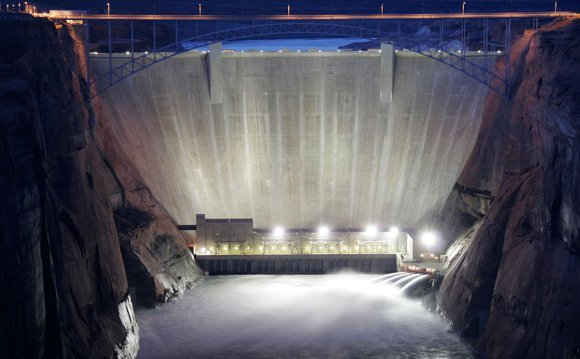

Harpman, D. (1999). Assessing the Short-Run financial price of ecological limitations on Hydropower Operations at Glen Canyon Dam. Land Economics, 75(3), 390-401. Recovered from Environment Complete database.

Hydro power calculator for kw energy. (2009). Recovered from

Map of real time streamflow versus historical streamflow for the day of the season (united says). (2010, Might 5). Recovered from

USA. Scraping the top: An Evaluation of Vermont’s Exterior Liquid Plan. By Elliot Wilkonson-Ray. Vermont Green Tax and Popular Assets Venture, Nov. 2008. Internet. Apr. 2010.